By Simon Eastman

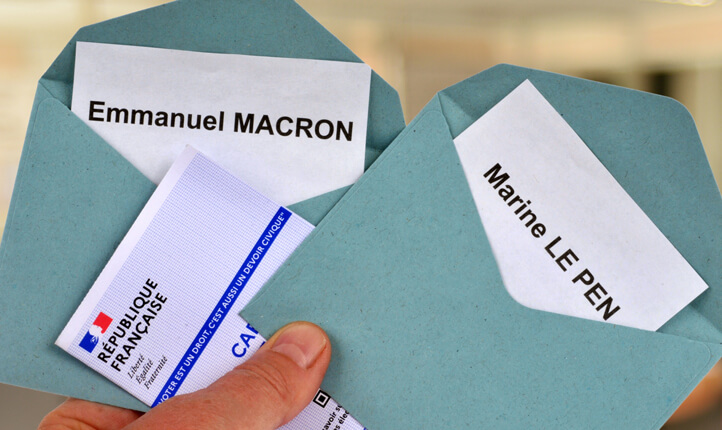

Headlines this morning focus on Emmanuel Macron, who has won the election race against Marine Le Pen, claiming a second term in office, the first time a President has done this in two decades.

In terms of currency, its done little to help the euro which is down against the USD and flat against the pound. Sterling lost around a cent and a half against the single currency last week, following some poor data figures, including lower than expected retail sales. An impending EU embargo on Russian oil is weighing on the euro and investors are seemingly edging towards a risk averse stance as we see the USD make even further gains across the board, taking another cent against the pound, reaching levels not seen since September 2020.

From the pound’s point of view, with growth slowing at a rapid pace, the Bank of England may be less aggressive with further action, as we have seen in the past few months concerning interest rate rises. The pound has been bolstered this year by the talk of a series of interest rate rises, having seen one in December and February already, and more expected. This may not be the case now, so those hoping for the benefit a rate hike brings to a currency, may be in for a longer wait. Given the move to more risk averse investing, and the shift to a more favoured USD, anyone with currency to buy from sterling may be prudent to trade sooner rather than later.

This week we have a few data releases for markets to move on, including the key ones below:

Monday – German business climate survey and Canadian Governor speech.

Tuesday – US durable goods orders and consumer confidence survey.

Wednesday – Australian inflation, ECB president Lagarde speaks twice.

Thursday – EU economic bulletin, EU consumer sentiment, German inflation, US GDP and US consumer sentiment survey.

Friday – German GDP, EU GDP, US inflation and Canadian GDP.

Plenty to go on so make sure you speak to one of the team here for some friendly guidance with any upcoming currency requirement.